This article is a collection of thoughts, data points and charts that help answer questions such as – a) Is there a Tech Winter? b) What is really happening in Tech?

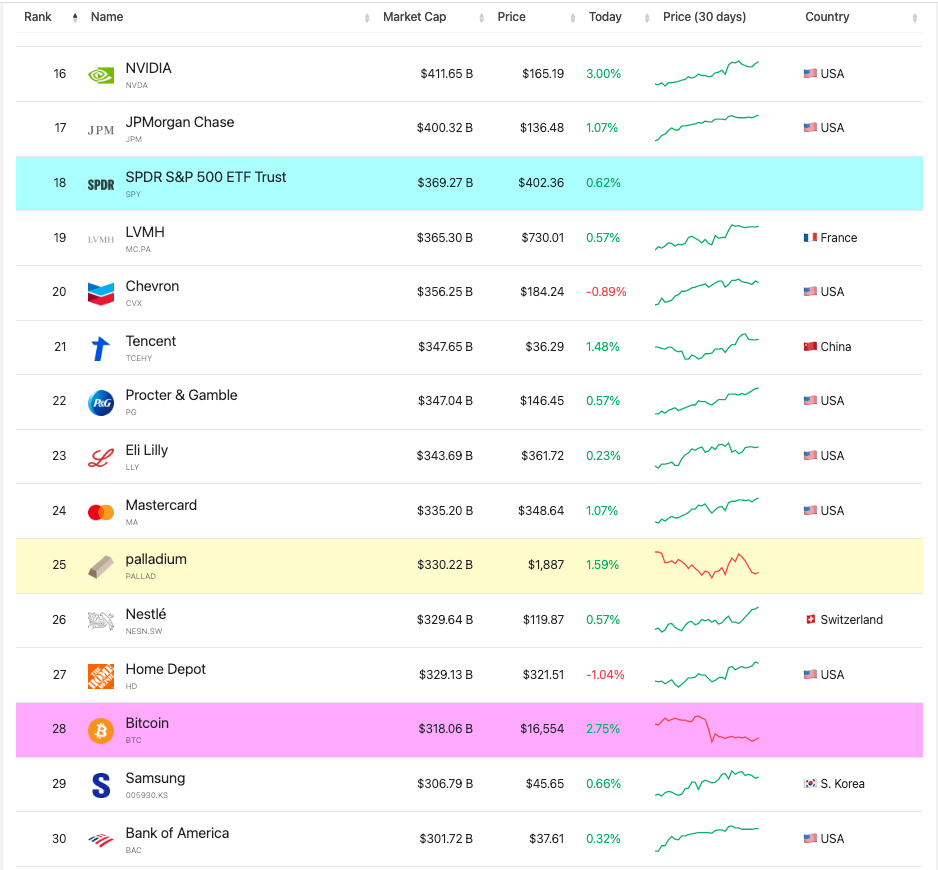

- Is there a Tech Winter? I would say no. Tech Companies are still some of the largest companies in the world.

2. Is there a Crypto Winter? I would say probably. Bitcoin’s asset ranking slipped significantly.

3. Bitcoin is the largest crypto asset and its value declined by 70% during the past year.

4. The Tech heavy NASDAQ Index valuation on the other hand lost 29% of its value during the last year.

5. However, Bitcoin’s value increased by 59% over the last 5 years.

6. In comparison the NASDAQ Composite rose by 64% during the last 5 years

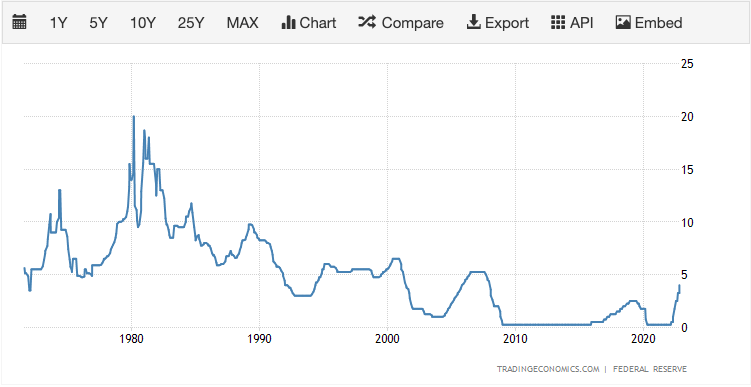

7. Interest rates have been rising rapidly and are now at a 14-year high. Tech stocks are mostly growth stocks and have lost a lot of their value due to rising interest rates. Also, companies are cutting projects that don’t deliver on short-term profitability/cash flow for the same reason. The valuation of these companies will start increasing faster as interest rates decline.

8. Some Tech stocks got a pandemic boost. Now the worsening economic outlook and historically high-inflation rates are resulting in reduced consumer spending on Tech. Revenue recovery is expected once inflation goes down.

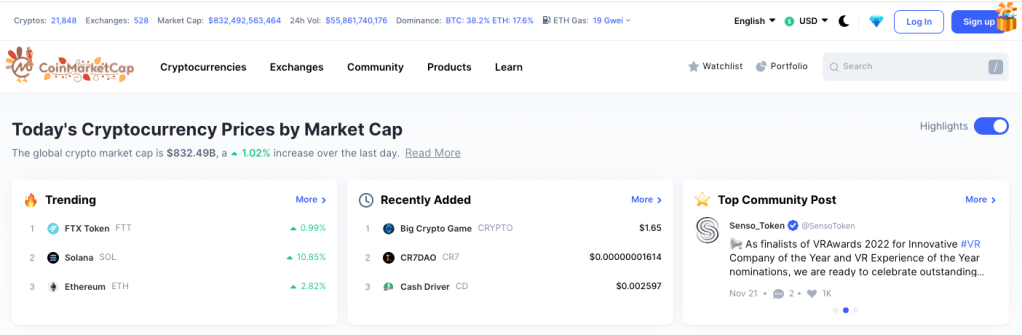

9. As per CoinMarketCap there are more than 21K Cryptos, many of which will cease to exist.

Conclusion

The Tech Sector is facing somewhat of a slump and a few shakedowns due to

- Rising interest rates

- A slowing economy and rising inflation

- Bad businesses

However, the overall tech sector remains relatively strong and will likely get stronger as inflation and interest rates subside.

Companies/products that rely on crypto and/or AR/VR appear to be facing higher risk relative to other Tech Companies. Even in high-growth areas such as Big Data and AI, there are winners and losers.

In conclusion, there are still many opportunities in Tech and the ultimate winners are likely to be the ones delivering short-term positive cash flow from business operations.